目次

サマリー

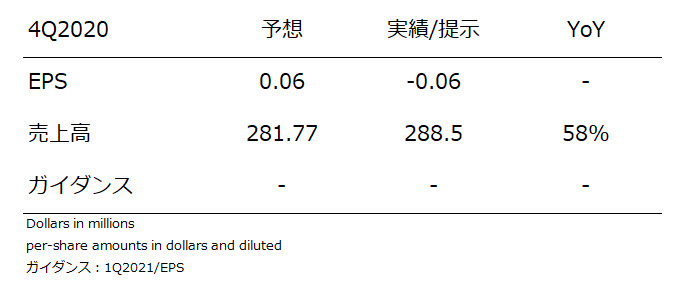

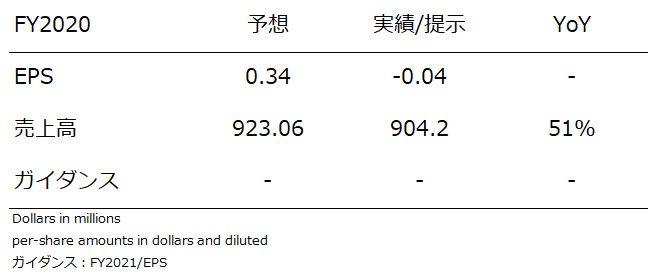

4Qの決算。良い決算とは言えない。

EPSは目標未達。売上高は到達。

YoY50%超は評価。

FY2021:Guidance

Net Store Growth:

- Maintenance: 80 to 90 stores; driven by roughly equal parts franchise and company-operated store growth;

- Car Wash: 20 to 30 stores; driven primarily by company-operated store growth

- Paint, Collision, and Glass: 60 to 70 stores; driven by franchise store growth.

Positive same-store sales growth

Adjusted EBITDA as a percentage of revenue of approximately 23%, consistent with fiscal year 2020.

- Adjusted EBITDA” represents earnings before interest expense, income tax expense, and depreciation and amortization, with further adjustments for acquisition-related costs, straight-line rent, equity compensation, loss on debt extinguishment and certain non-recurring, non-core, infrequent or unusual charges. Please refer to Non-GAAP reconciliation tables located in the financial supplement in this release.

ということで、具体的な数値目標の設定は無。

今後の見通し

良いビジネスモデルと思います。

しかし。

コロナの影響を正確に把握できていない経営陣への評価は下がりました。もう少し様子を見たいと思います。

具体的には、2Q2021の決算まで待ちたいと思います。